You’ve probably seen this happen.

The stock market rises for two straight years. Portfolios are up 25%, maybe more. Everyone’s happy — but not exactly celebrating.

Then one week, the market drops 10%, and suddenly… chaos.

Panic posts. Doomscrolling. Money pulled out of retirement accounts. Everyone acting like the sky is falling.

What gives?

Why does one bad week feel worse than two years of steady gains?

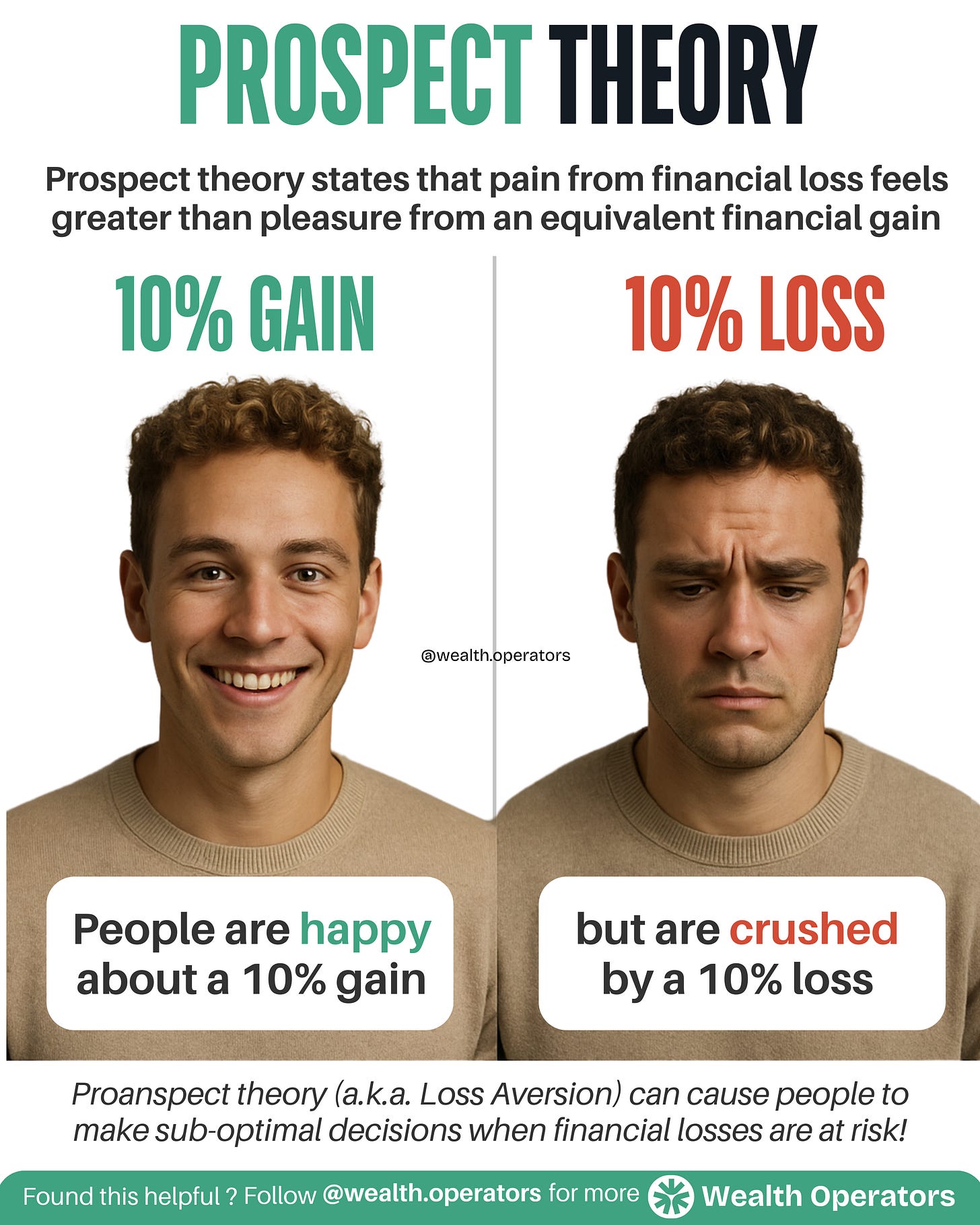

Enter Prospect Theory — a behavioral economics principle that explains why we’re wired to make bad financial decisions.

It’s simple:

Losses hurt more than gains feel good.

Even if the amounts are the same.

This theory was first described by psychologists Daniel Kahneman and Amos Tversky. Their research found that people experience the pain of losing money about twice as intensely as they enjoy gaining the same amount.

This is called loss aversion,- and it’s probably wrecking your financial decisions without you even knowing it.

We’ll explore why your brain behaves this way, how it’s hurting your wealth, and how to outsmart this bias before it sabotages your future.

Why Your Brain Is Wired To Lose Money

Most people think they’re logical with money.

They aren’t.

The moment red numbers show up on their screen, the primal brain takes over. Fight-or-flight kicks in. The modern equivalent of a lion in the bushes is a CNBC headline flashing “MARKET TANKS 10%”.

And what happens next?

They sell.

They retreat.

They regret it.

This is not because they’re dumb. It’s because their brains are built for survival, not investing.

Kahneman and Tversky discovered this in their groundbreaking work on decision-making. They asked people how they'd feel about a guaranteed gain of $100 vs. a 50/50 chance to win $200 or get nothing.

Most people preferred the sure thing. But when the same logic was flipped to losses, people gambled more to avoid a sure loss — even if the expected outcome was worse.

We’re more motivated to avoid pain than pursue gain.

Here’s the big "aha!":

Your brain treats money like food and shelter. Losing it feels like death.

But in today’s world, selling during a market dip to avoid emotional pain is the equivalent of torching your crops because of a cloudy forecast.

Let me give you a real example:

A friend of mine sold off their entire portfolio in early 2020 — just before the market bounced back. They avoided a 15% drop… and missed a 70% gain over the next year.

That’s the cost of letting fear drive your decisions.

So what’s the solution?

It’s not to feel less. You’re human. It’s to build a system that helps you act rationally even when you don’t feel like it.

That’s where Investor EQ comes in.

Mastering Investor EQ: The 5-Step Framework

70% of retail investors underperform the market. Not because they lack strategy — but because they let emotion win.

Here’s how to take back control:

Step 1: Name The Bias To Tame The Bias

Label the fear.

When markets dip, say it out loud: “This is loss aversion talking.”

Awareness alone gives you leverage over your reaction.

Step 2: Reframe Losses As Tuition

Every loss is a lesson you paid for.

The market is your university — and dips are tuition fees.

You’re not being punished. You’re being trained.

Step 3: Use The 72-Hour Rule

Emotions lie.

So when fear spikes, wait 72 hours before making any financial decision.

Let your logical brain re-enter the chat.

Step 4: Automate Your Rationality

Set it and forget it.

Use tools that help you stick to the plan — auto-investments, rules-based rebalancing, even if-this-then-that strategies.

Example: “If my portfolio drops 15%, I invest 5% more.”

Step 5: Track Reactions, Not Just Returns

Your portfolio’s not the only thing to measure.

Start a journal to track your emotional responses.

Patterns will emerge. You’ll begin to predict your fear — and override it.

Conclusion:

Prospect theory isn’t something you “fix.”

It’s something you outmaneuver.

By recognizing the trap, reframing your thinking, and building systems that protect you from yourself, you’ll make decisions that multiply wealth — instead of reacting in ways that shrink it.

Control your brain.

Control your wealth.

Enjoyed these insights? Don’t keep them to yourself. Forward this newsletter to someone who could benefit.

Stay wealthy,

Be Wealth Operator